The $1200 Challenge: 5 Proven Strategies to Lock Down Affordable Housing (Even in Expensive Markets)

Download MP32022 is probably the most important year to take the suggestion just to jump into a cheap house rental prices are going through the roof this is an article from los angeles where rents are at insane levels not just in los angeles but across the u.s we've seen it in north carolina boise idaho small towns in montana i'm sure in your town you're seeing rental costs jumped through the roof where an apartment used to be eight or nine hundred or a thousand now it's 1500 and it's going to go up again after that.

And the reason why is because in some cases landlords are gouging and and profiteering but in some cases their costs are going up too well what happens when a house is priced reasonably in the marketplace well here's an example where a house in north carolina was like a feeding frenzy there was people all over with a traffic jam in the neighborhood trying to see this house and the realtor or might have been a neighbor had a little video where let me put the the sound off so it won't interrupt.

Where it was recorded the activity in this neighborhood you can see cars lined up down the block people walking all over the place up and down the street a frenzy of people trying to see this one house because it was priced at two hundred and sixty thousand dollars one house they estimated that there were over 200 people came to look at this one house as soon as it hit the market it was like an amazing um concert ticket camp out right so what is the reason for this well it's because there are no houses like that well maybe there is well let's take a look.

First of all why somebody would want a house at that price here's a mortgage calculator for a house that's around two hundred thousand dollars we plugged in 220 for the price 10 down payment so 22 000 down payment so you're financing about 200 well your base mortgage payment is only a thousand dollars that's going to be less than you're paying in rent for a two-bedroom apartment in most places you're going to have some additional monthly fees your property tax is probably going to be two or three thousand dollars a year and that'll be put into your put into your mortgage payment and you'll probably have to pay insurance your homeowner's insurance of about seven or eight hundred dollars but if you have an apartment you may have a renter's insurance already that's a few hundred dollars a year so you may not actually have all of this to add onto your budget so for a 200 000 house you can be in for under 1400 in most cases and we put in a reasonably average credit score and an interest rate that's not really low 4.5 if you really shopped around you could probably get a little bit less than that but the rates are probably going to go up anyways.

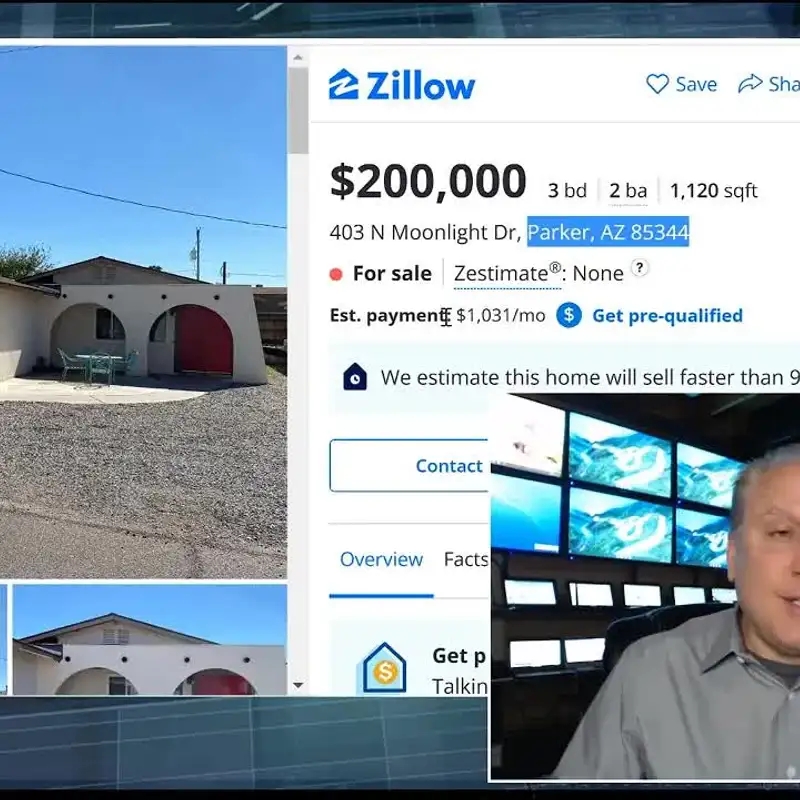

Well what kind of house can you get for 200 000 well if you've seen in other videos there's many houses available all around the country here's one in parker arizona it's 1100 square feet three bedroom two a bath house um you know kind of like a mission style adobe house two-car garage and it's also near colorado river it's near a lot of boating a lot of recreational type things and in addition to that looks like it has a carport besides the garage but here's the backyard it's right on on the water right and this is an area where there's a lot of recreation people go to lake havasu and go to a lot of other kind of touristy type things parker arizona you may not want to move to parker arizona that's fine there are 200 000 houses in every part of the country within an hour or so of any major city you can think of.

In this day and age with work from home and remote employment doesn't really matter where you live and you might say well i don't want this kind of house this house is beneath me or i really want my dream home well if at this point your dream home is five or six or seven hundred thousand and either you don't have the down payment or the income that's fine at least jump into this it's better than renting what do you have to lose when you rent all of your money that you spend every month fifteen hundred dollars a month eighteen thousand dollars a year is wasted it goes to the landlord goes to the property owner it's all gone.

If you buy a house your money is going towards your mortgage maybe not a lot at first because it's mostly interest but it's also tax deductible because you can deduct that interest off your taxes and you're also building equity more importantly if this house goes up even five percent next year now it's going to be worth 210 000. well properties went up 20 last year so even if the rate of increase goes down you're going to make 10 000 just sitting in that house more importantly your downside is not that much how much less could this house be worth in five years or four years or three years it's not gonna be worth less than two hundred thousand we're not in a bubble where people are getting these crazy mortgages and interest interest-only mortgages where they're just going to walk away and these housing prices are going to crash.

If anything there's inflation more coming to the economy because of lumber prices fuel prices all of the other debt that's built into the economy that's a whole other subject for economic analysis you don't really need to care about the national economy you just need to care about your personal economy and buying a 200 000 house is almost a no lose situation you're going to spend about the same as you have for rent and it's fixed it's locked in the landlord can't raise your rent if you're paying 1100 a month right now or 1200 or 1500 next year they could add on 200 or out on 250. if you have a mortgage and you own your house the landlord can't raise your mortgage payment nobody can raise it up because it's locked in.

And if you ever decide you want to move up in the world and maybe buy a six hundred thousand dollar house or a four hundred thousand dollar house if the housing prices go up at least you are on the bandwagon of recognizing profits on real estate if you're renting you're just chasing a moving target that 400 000 house that you want to have today that you can't afford might be 500 in three years or 607 years at least if you buy a 200 000 house if it goes up to 250 or 260 or 270 in a few years you can use that equity to offset what your dream house may have gone up in value.

Are there going to be some expenses yeah you might have to keep some money for you know maybe fixing the plumbing or fixing electrical but you'll also learn homeowner skills how to repair things yourself you don't need to rely on a landlord to fix your plumbing you can do this yourself more importantly you will get the benefit of appreciation of a property if the obstacle or your hesitation is because maybe you don't want this kind of a house maybe you want a different kind of house at least get something it's better than an apartment that you don't own you have a place to park your car you can start also accumulating assets that will help you have lower cost of life.

Look if you have a little box with some tools that you use to hang pictures you're not going to be able to fix a sink or to fix your car if you start if you have a garage where you can start storing things that will help you have lower expenses in life because you can do things yourself or you can buy something today that maybe you need in a year that won't have the same price a lot of homeowners are making five or six hundred dollars a year because they're buying groceries six months in advance and putting them in a pantry because your grocery bill today if it's 300 2 years ago was probably 180 a month so you can actually save some money by having a place to store things that might be higher priced down the road there's so many advantages of doing it.

Look we're not real estate agents we have nothing to gain from this we're not profiting from real estate at all we're just trying to give economic suggestions that might help consumers avoid being priced out in the future again here's your mortgage payment a 200 000 house is about a thousand bucks a month compare that to your rent and think about what upside you might have if this 200 000 house is worth 210 or 220 or 230 in a few years that's like making 30 000 by doing nothing just continuing to do the same thing you do live in a place paying your monthly payment and you won't have to worry about these rental price increases that are insane and it says no end in sight.

Well how far out can economists see two or three years at least so what they're saying is for two three years this is not going to level off in fact this article is ktla in los angeles but this phone number 786 this is miami so this covers the whole country keep it in mind as an option watch our channel watch our website we're going to list examples of 200 000 houses all over the country on a regular basis some will have acreage some will have near the beach near the ocean some will be in the mountains you'll see these themes that will show up that will give you an idea of what you can buy and you can find this anywhere good luck with your residential pursuits and we'll see you in the next video.