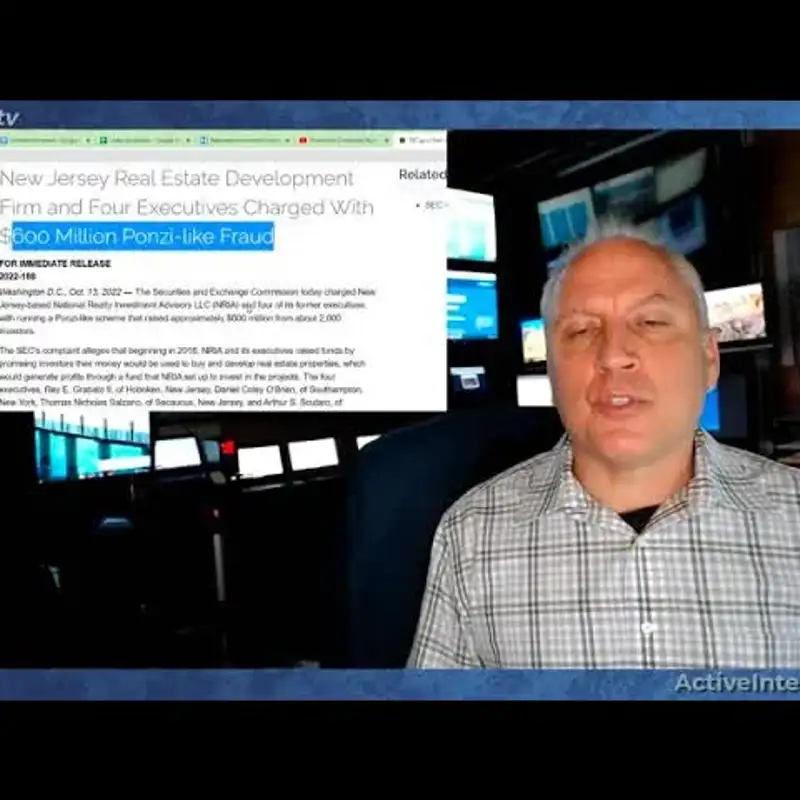

NRIA Unmasked: From Real Estate Dreams to SEC-Labeled Ponzi Scheme

Download MP3Episode Description / Show Notes:

- We revisit our investigation into National Real Estate Investment Advisors (NRIA), a company previously flagged for suspicious activity.

- Listeners may recall our earlier exposé revealing troubling facts, including:

- One executive using a fake name.

- A criminal history tied to prior fraud.

- As of last week, the U.S. Securities and Exchange Commission (SEC) has formally charged NRIA with operating a $600 million Ponzi scheme.

- The company and its former executives allegedly:

- Promised investment funds would be used for real estate development.

- Used new investor funds to pay earlier investors (Ponzi scheme behavior).

- Funded luxury purchases and personal expenses.

- Paid reputation management firms to block due diligence efforts.

- The company heavily advertised on major networks like CNBC and Fox News.

- Our earlier investigation faced interference from these reputation firms.

- We uncovered evidence of:

- Falsified marketing and financial statements.

- Misrepresentation of investment performance.

- The SEC charges validate many of the red flags we identified years ago.

- While these are still allegations, government involvement may help victims begin the recovery process.

- This case serves as a reminder of the importance of due diligence and investigative journalism in uncovering fraud.